FMP

Three Most Important Financial Statement - Detailed Guide

Sep 30, 2022 3:32 AM - Jack Dalton

Image credit: Kelly Sikkema

A financial statement segments into three divisions; Balance sheet, income statement, and cash flow statement. Among these 3 major financial statements, the most important financial statement is the income statement. Since it highlights a company's capability to generate profit in a particular duration, investors could calculate its future stock rate accordingly. Furthermore, the analysis made under the income statement represents the current dollar's estimation, which solves most of the convulsions concerning shareholders' profitability expectations.

Importance of Financial Statements

The financial statements are documented calculations of a company's financial position and operational terms. It conveys investors or shareholders a clear structure of the company's present income record, equities, and assets. This information helps investors ensure the reliability of the company's business they are going to invest in.

Because these statements provide the actual view of a company's financial location, government agencies, specific firms, and accountants conclude them. It is essential to give shareholders the company's actual performance in the market and surety of how this investment plan will prove a productive decision for investors to wisely invest in shares without hesitating and doubting its financial score.

But before you skip investing in the stock exchange, you need to figure out the analysis terms mentioned in the company's annual reports, where most companies use to share their summarized financial statements.

Take it easy if you are a beginner and didn't interact with financial statements in the past.

This post reveals the moderate to most important financial statements' entire configuration, which businesses carry to present their economic scalability to the investors.

So, let's start with the three primary financial statements highlighted below.

Types of Financial Statements

There are 3 primary financial statements discussed, among which the income statement is the most important financial statement. But letting you concentrate only on income statements, it's essential to understand the other two financial statement descriptions. It's mandatory because without clearing the figures batting around each type of financial statement, you could not approach the level of accuracy in a particular company's financial condition.

Let's start with the Balance Sheet:

1. Balance Sheet

The balance sheet is a required financial statement that demonstrates an overview of the company's assets, liabilities, and shareholder's equity at a specific spot of time. It consists of two sections; one covers the assets, and the other comprises the sum of liabilities and shareholder's equity. These sections appear combined in the form of a balance sheet formula where assets calculation would be measured by adding liabilities in the shareholder's equity or net worth.

Assets = Liabilities + Shareholder's Equity

The balance sheet also provides that the company's assets are either financed by debts or by equities.

Components of the Balance Sheet

The balance sheet comprises three elements and creates a proportional relationship between them. But the liabilities and assets are the two most prominent figures to define under the balance sheet that you need to know before reading it.

Assets

Assets are the economic values owned by companies to become helpful in future activities regarding the business. Things that could perform as assets include cash, inventory, office equipment, vehicles, real estate property, and machinery. Based on liquidity time, assets can be divided into two following types:

- Current or short-term assets: Those assets that are highly liquid or can instantly be converted into cash (within one fiscal year) to regulate the present operational activities and expenses of the businesses are called current assets. They include cash, marketable, employee accounts receivables, etc.

- Non-current or Fixed assets: Fixed assets draw long-term benefit for the company and are liquidated after one fiscal year. These include land, copyright, trademarks, bond sinking funds, etc.

Liabilities

Companies are responsible for refunding the loans taken up from government sector banks to concrete the company's performance and improve the business. These refund obligations are the company's liabilities to declare in front of investors so they could estimate the financial statement accordingly. These liabilities could come as:

- Current Liabilities:These liabilities have to be cleared by the company within one fiscal year or 12 months. Dividends payables, account payables, and short-term loans/debts are categorized into current liabilities.

- Non-current Liabilities:Long-term or non-current liabilities need to be cleared after a fiscal year time. These include long-term debts, lease obligations, bonds payables, etc.

How to read the Balance Sheet

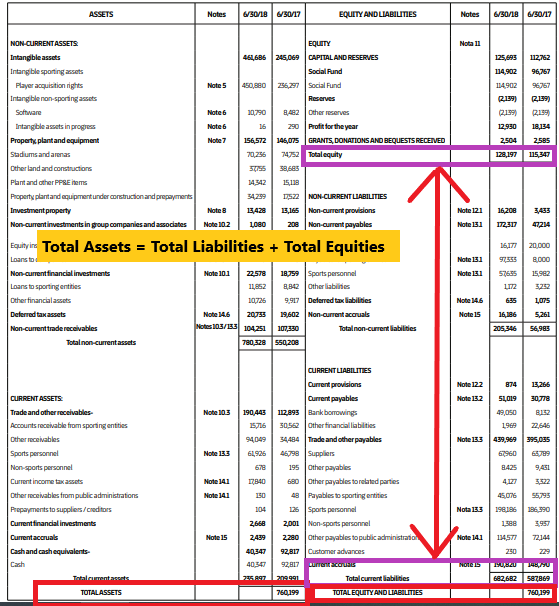

To read and understand the balance sheet, let's take an example of EY company's Financial Statement for the year (2017-2018), listed on the British Exchange and headquarters in London.

The above-pasted balance sheet is, however, looking challenging to digest, but some key points you need to know out of this complete analysis involve:

- The total assets are equal to 760,199 Euros.

- The total equities and liabilities sum is equal to 760,199 Euros.

- The number of liabilities must be lesser than equities.

Now let's see: How the balance sheet compensates debts and equities?

Let's experience recording a deal on a balance sheet. If organization ABC gets a five-year loan from government division banks for an expense of Rs 10,00,000, it indicates that the lender will give the dealt amount to ABC Ltd.

The records administration will extend the money element by 10,00,000 on the assets head, and consequently, enhance the long term liability record with the equivalent value, thus adjusting both the fronts lie on the same level.

If an organization increases Rs 20,00,000 from shareholders, its assets will grow by that volume, similarly to its shareholder's equity.

Importance of Balance Sheet

The importance of financial reporting could be seen through only the balance sheet assistance for investors understanding the business's insights. Total three insights about a particular industry could be narrated if you have reached out to its balance sheet. These include:

- Liquidity:Comparing the present assets with the present liabilities/debts portrays a transparent image of how much cash is readily available to a company.

- Productivity:Contrast the income statement and balance sheet to get the company's productivity measurement.

- Strength:By comparing the liabilities with equities, you can observe how much strength the company has to demotivate the financial risks and other economic breakers.

2. Income Statement

An income statement shows the company's revenues and expenditures within a specific duration of operational activities. It is also called a “profit or loss statement” and “earnings statement,” which provide investors to negotiate how fast the company could leverage its financial pillar and which points are responsible for raising the expenses. It is categorized as the most important financial statement among the three because it supports a clear demonstration of profits and loss in the company flow of financial statements. Organizations start releasing income statements at a point when banks and shareholders require the gross profit and net expenditure calculations; that could be based on yearly terms or six months durability.

Importance of Income Statement

The income statement helps investors or business owners to investigate whether raising the revenues or decreasing the costs could emerge the status of financial efficiency or not. One can easily comprehend how the income statement is the most important financial statement over others in the queue in the following points.

- Quarterly and Monthly Reporting: Unlike other required financial statements, companies release their income statement frequently, with a month or quarter year duration. This short-spun income reporting provides a significant margin to calculate the condition of the company's profitability in the past month and how it will raise its efficiency in the coming future. It serves as a tracking tool to let investors conclude the revenue and loss percentage regarding a specific time point.

- Expenditure holes identification: The income statement covers many points of a company where the expenses are likely to occur, including employee hiring, renting, salaries, regulation of the production, etc. In comparison to large or stabilized businesses, the small ones have more expenditures due to become stable.

- Complete Representation of the Company: The income statement gives shareholders a comprehensive overview of the business in which they are deciding to invest and gain equal profit. Moreover, the banks from which companies are looking to acquire loans also require an income statement to see whether the company is eligible for owing a loan or not.

How to understand an Income Statement?

There are two types of income statements to understand and calculate the net profit of the company. These include:

- Single-step income statement.

- Multi-step income statement.

Single-Step Income Statement: In this type of income statement, the net income revolves around a single formula statement which deals with the addition of expenses/loss and profit/revenue.

To understand this thoroughly, let's suppose a local sports club has total revenue of $45,000 which is $36,000 Merchandise sales and $9,000 of Training revenue. The total expenses are $17,000; including all the procurement costs, wages, rent, transportation, and utilities. On the other hand, the total gains are $3000 and the total loss is $1000.

For calculating the net income of this income statement, the formula goes as:

Net Income = (Total Revenues + Gains) - (Total Expenses + Loss)

By putting the statement values in the above formula we can easily have the net income of the sports club:

Net Income = ($45,000 + $3000) - ($17,000 + $1000) = ($48,000) - ($18,000) = $30,000

Hence, the net income generated by the sports club in each 6-month duration is $30,000.

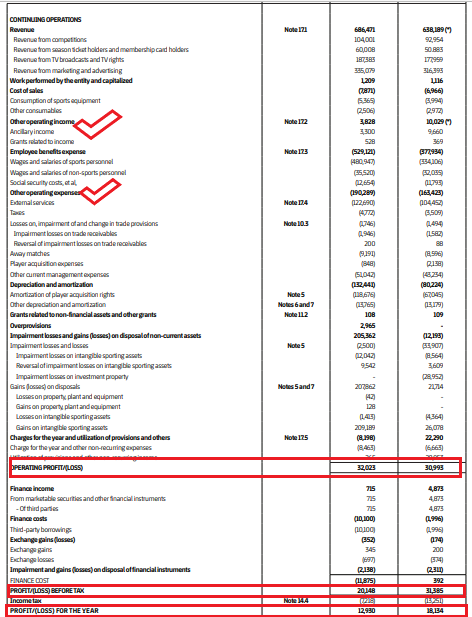

Multi-Step Income Statement

Businesses that function at the international level produce a broad spectrum of commodities and services and associate themselves with organizations and corporations. Due to certain movements, they have a complicated schedule of ventures and interests to heed. These businesses also have to follow explicit financial reporting arrangements. So larger organizations select multi-step income statements. In this method, operating revenues, operating expenses, and gains are divided from non-operating revenues, non-operating expenses, and losses. Net income is expressed in four directions: gross, operating, pre-tax, and post-tax. The following sample applies the multi-step income statement configuration because of the complex terms described in this income statement.

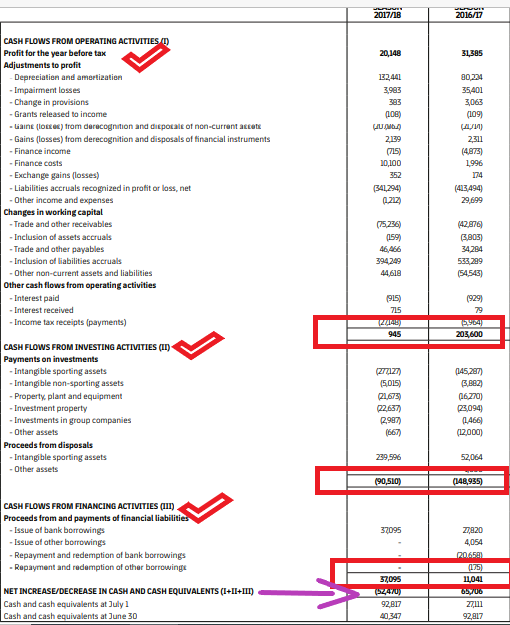

3. Cash Flow Statement

The cash flow is the basic financial statement that reports cash generated and utilized as a company's expenditure within a specific time period. You need to know it before investing in shares because its segments inform the cash fluctuations to understand the acceleration of cash flow in a company financial statement. Among the three most important financial statements, this has its own worth and splits into three components to give proper information of flowing cash:

Cash flow from investing activities:

This section of the cash flow statement indicates the amount of cash being used or generated in the investment procedures of the company. Investment practices involve purchasing the PP&E assets, cooperating or merging with other businesses, and considering bonds or stocks investments. We can also recall this in a formulaic form:

Cash flow from investment = Sales/purchase of long term assets + other businesses + marketable securities.

Cash Flow from Operating activities:

It involves all the amount of cash used to purchase or sell the products, building up revenue, expending on activities regulations, and funding capitals. The cash flow from operating activities also reveals how much cash inflows and outflows the company made for maintaining the functionality. Its formulaic expression is:

Cash Flow from Operations = Net Income + Non-Cash Things+ Settings in Working Capital

Cash flow from Financing Activities

Cash Flow from Financing Activities is the exclusive sum of funding a business produces within a negotiated time limit. Finance exercises involve the issuance and recompense equity, the return of profits, issuance, the recompense of securities, and property contract commitments. Organizations that demand property will advance money by declaring liability or investment, and this will be speculated in the cash flow assertion.

It can be seen in the above cash flow statement of EY company that its cash flow from operating activities is less than previous fiscal year's estimations. This may have a great impact on the company's profitability. It conveys investors the least effective progress of the company in managing or heading operations to generate profit.

Other Blogs

Sep 11, 2023 1:38 PM - Rajnish Katharotiya

P/E Ratios Using Normalized Earnings

Price to Earnings is one of the key metrics use to value companies using multiples. The P/E ratio and other multiples are relative valuation metrics and they cannot be looked at in isolation. One of the problems with the P/E metric is the fact that if we are in the peak of a business cycle, earni...

Sep 11, 2023 1:49 PM - Rajnish Katharotiya

What is Price To Earnings Ratio and How to Calculate it using Python

Price-to-Earnings ratio is a relative valuation tool. It is used by investors to find great companies at low prices. In this post, we will build a Python script to calculate Price Earnings Ratio for comparable companies. Photo by Skitterphoto on Pexels Price Earnings Ratio and Comparable Compa...

Oct 17, 2023 3:09 PM - Davit Kirakosyan

VMware Stock Drops 12% as China May Hold Up the Broadcom Acquisition

Shares of VMware (NYSE:VMW) witnessed a sharp drop of 12% intra-day today due to rising concerns about China's review of the company's significant sale deal to Broadcom. Consequently, Broadcom's shares also saw a dip of around 4%. Even though there aren’t any apparent problems with the proposed solu...